It’s about recognizing that customers, not product developers or service providers, are now in control of commerce.

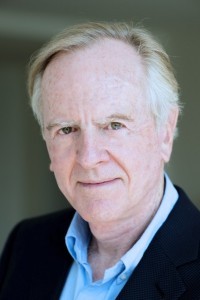

John Sculley may be 76 years old, but he doesn’t live in the past or moon wistfully for its return. In both his book, “Moonshot!” (Rosetta Books, 2014), and an interview with CFO, the storied former chief executive of both Apple and PepsiCo is fully immersed in emerging technologies, today’s customer behaviors, and how they should steer 21st century entrepreneurs.

“Moonshot,” a word well-entrenched in the Silicon Valley lexicon, derives from President John F. Kennedy’s 1961 vow to put a man on the moon and bring him back safely before the end of the decade. To Sculley, it refers to an event that changes the world. The Internet becoming available to personal computer users in 1994 was a moonshot. A quartet of technological moonshots are playing out currently, he points out: cloud computing, advanced data analytics, mobile devices, and the proliferation of tiny computerized sensors that comprise the Internet of Things.

Almost any company with a bright future is leveraging some or all of those massive technology trends. But the moonshot of the book title is something else, even if it owes its existence to them — that is, “a dramatic, rapid shift from producers-in-control to customers-in-control,” writes Sculley, who has been investing in and helping to create startup companies since leaving Apple in 1993.

“Customers have complete access today to information unheard of a few years ago,” he writes. “This includes where to find the best price, how products and services are rated by users, and what their friends recommend. And they can buy instantly with the click of a smartphone. The richness of this information will continue to grow exponentially in the future. It’s almost unimaginable how fast this will happen and the power it will give the customer.”

Companies that don’t grasp what’s happening are doomed, according to Sculley. Following is an edited version of our discussion with him.

Who is “Moonshot!” aimed at?

Anybody at a certain level in a company, whether it’s small or medium-sized, or an entrepreneurial startup, or even a large company that’s going through a transformation, like IBM, Hewlett-Packard, and Dell. They’re all trying to reinvent themselves, and it’s possible through financial engineering strategies that align with transforming a business.

Look at IBM. Twelve consecutive quarters of down misses. People wonder whether the CEO is going to keep her job. On the other hand, she has said quite articulately that she has got to pivot, that there are times when big corporations have to reinvent themselves, and she’s at one of those moments. And if she doesn’t make those bets on Watson, artificial intelligence, and cloud, IBM is eventually going to be toast.

You wrote that not only are customers in control, they’re going to be in control from now on. Is that a bit premature? Lots of things are cyclical even though they don’t seem to be, because the cycles are so long.

Well, who can say “forever” about anything? I think it would be a little bit arrogant for me to say forever. But I think certainly for the foreseeable future, say at least the next 10 years — and anybody who makes a prediction more than five years out is doing pretty wild speculation — customers are going to be very much in control.

In light of customers having gained control and the declining middle class since the recession, you highlighted “disruptive” pricing as a key to launching or transforming a business.

The real challenge for the middle class is that the model people have in their minds today is not one that’s affordable for many Americans: two $30,000 cars in the garage, a 2,000-square-foot house, [expensive] vacations, even second homes. Businesses need to adjust how they deliver products and services to the aspiring middle class, but this time, instead of exporting all our ideas to the rest of the world, we may in fact import some ideas from Asia, where there are several billion people aspiring to be in the middle class. But to them that’s one $7,000 car, no garage, and a 1,000-square-foot apartment.

Over the last 15 years not only have wages not gone up, they’ve gone down in real dollars for let’s say the lower-earning 50% of the population. Some people have asset-driven income, and so if you had an asset, whether stocks, real estate or savings, you’ve seen an appreciation. But more and more of the wage-income people are dropping out of the middle class. How do we keep them in anything close to the lifestyle they were accustomed to? We keep giving out government subsidies. So we’re now up to 47 million people who get food stamps.

This is driving what’s called the sharing economy. Millennials are getting very comfortable with services like Uber, Lyft, Zipcar, and Airbnb. These services are saying, you don’t need to keep score by what you own. It’s all about what you need when you need it.

As for disruptive pricing, look at the examples. In Asia there’s a company called Xiaomi that introduced a complete knock-off of the iPhone but on the Android [platform]. They sell it for a very disruptive price. This company is less than five years old and is valued at $45 billion.

You can see the same thing with Amazon, with FlipKart over in India, and Indigo Apparel, a Japanese company that has a lot of material science in its products. As I say in my book, I buy a lot of Indigo’s products because they pack so well, and they’re really inexpensive — you can get a whole wardrobe for a couple hundred dollars.

Speaking of Amazon, in your book you write, “The ability to scale supersedes the traditional profitability metrics we’re accustomed to using in projecting a business’s ability to survive and thrive.” Well, Amazon has scaled, to almost $90 billion in revenue. Does the time ever come when they need to make a profit? Or can you scale forever?

You know, life isn’t fair, and Amazon gets to play by different rules than most of us. They’re creating so much value for customers and growing so fast, they’re getting a pass from the capital markets and the stock markets. The theory is that they could raise prices and turn on the profit anytime they want. Amazon says, we’re still in the early stages of what we’re trying to accomplish, we’re not trying to make a profit, and by the way we don’t like to pay taxes on profits.

And parts of Amazon are quite profitable. If Amazon Web Services were a freestanding company, put a multiple of four or five times on its estimated revenue and you’re looking at north of a $20 billion market-cap company that’s profitable.

One of the book’s tenets is that “now is the best time to build a billion-dollar business,” and that one reason for that is access to low-cost capital. I spoke with a hedge-fund guy recently who said low interest rates are just keeping alive a bunch of poorly managed companies that should be allowed to die off. What’s your take?

There’s some truth to that. There’s always going to be collateral events with any public policy. But I think the reality is that the private equity world has taken advantage of the low-cost capital and gone in with very smart financial engineering.

The frustrating thing is that the banks have been so focused on improving their balance sheets and paying the extortionist settlements, the latest being Deutsche Bank. Those settlements are outrageous, and the money is going to the government, so it’s kind of an inside game. But the banks have also been bulking up on low-cost money. As the Fed prints money, the banks are able to create an arbitrage where the government is like a cash machine. That cash allows them to fatten up their balance sheets, which the government likes because it wants banks to have higher capital ratios, and it lets strong banks be stronger, lets people get big bonuses, and gives the overall economy a safety net against failure by the big banks.

But what it’s not doing is flowing a lot of capital into new infrastructure builds. With these interest rates you’d think everyone would have easy access to money, but for a small to medium-sized business it’s still really hard to borrow. Again, life isn’t fair, and you have easier access if you’re a large borrower.

CFO’s audience would probably be interested in another statement from the book, that “the business planning concept is dying” in favor of “customer planning.” You wrote, “A customer plan should be a concise document outlining how the company will significantly improve the customer experience to make it the best by far in your industry.” But then, don’t you still need a business plan?

I dramatized a bit because I wanted people to pay attention to the idea of a customer plan. What is a business plan? It’s looking back before you look forward. It’s really a budgeting process, for all intents and purposes. Here’s how well we have done, therefore how much can we improve in the next year? Then it’s negotiating what existing parts of the organization should get additional spend.

There’s nothing particularly strategic about that. What’s the mission of big corporations? To keep doing what we’re doing, but do it better. Continue to show improvements in the traditional metrics that we’re bonused on, like return on capital, return on equity, sales growth or EPS growth, which by the way have very little to do with anything the customers are interested in.

What I’m saying is that a customer plan is far more telling in terms of what can we do to really disrupt, to innovate, to dramatically change the business. And that starts with: What’s a really big customer problem that needs to be solved? Can we solve it, and if so, how well? How do we engage the customers? Then, what’s the cost of customer acquisition? How do we retain customers? Customer metrics are far more telling about whether you’re doing the right things to not miss an opportunity and maybe build a way of looking at an industry that nobody has ever thought of before. And if you don’t do it, somebody else probably will.

You wrote that the amount of data available to consumers will continue to increase rapidly. As a consumer myself, when I hear that I think, “Do I really want more data? I’m already on overload.” Is there such a thing as too much data?

You could say consumers are just going to be blasted with ads every time they pick up a smartphone or turn on the television or look out the window. But the reality is that things are going to happen automatically for you. You walk into a store and don’t have to do anything. The systems will know who you are, where you are, what aisle you’re standing in, what product you’re looking at, whether you’ve ever bought a product like that before, what other attributes about you make you an interesting possible purchaser, and then give you an instant offer that will be different for you than it will be for me.

So more and more the goal is going to be making the processing of data more invisible while at the same time making the outcome more valuable. And it’s all about machines taking over more work.

The thing I don’t think people have wrapped their heads around yet, although it’s so obvious it’s going to happen, is that just like we saw robots and computers replace a lot of blue-collar work over the last 40 years, we’re now at a point where we’re going to see increasingly higher-skilled work being replaced by smart machines.

That has huge implications for not only the way work gets done, but also the cost of making products and services and ultimately the prices at which products and services are sold. Then the big question is, will there be anybody left to buy them, if there aren’t enough jobs to go around?

That begs the question: what’s your view of the Singularity, the hypothesized point in time when machines get smarter than humans and maybe take over?

I think it’s science fiction. There are a lot of subtle things that even a baby can do instinctively that we can’t yet do with our smartest supercomputers. Ray Kurzweilsays it will happen by 2045, but my sense is that [making such a prediction] is about more than just calculating the amount of data that can be processed and stored and a machine’s ability to learn. If it does happen, I don’t think it will be in this century. But then, I’m not a brilliant computer scientist.

Last question. Do you have a viewpoint on the state of the CFO role?

Sure. It’s never been more important, and it’s pretty obvious why. For one thing, the speed at which businesses have to adjust today is unprecedented. And when you adjust, there are huge ramifications for working capital, raising capital, and the cost of capital.

Also, the more data drives the business, the more important the CFO is. The real business drivers are happy customers, lots of smart data, and following the cash. The CFO is dealing with at least two of those. The job is only going to get bigger.